Small Business Valuations for SBA Lenders

In the early 2000’s, GCF wrote the SOP, or rule book, for SBA 7(a) small business valuations as a trusted partner. We are the industry veteran serving SBA Lenders for over 23 years and counting.

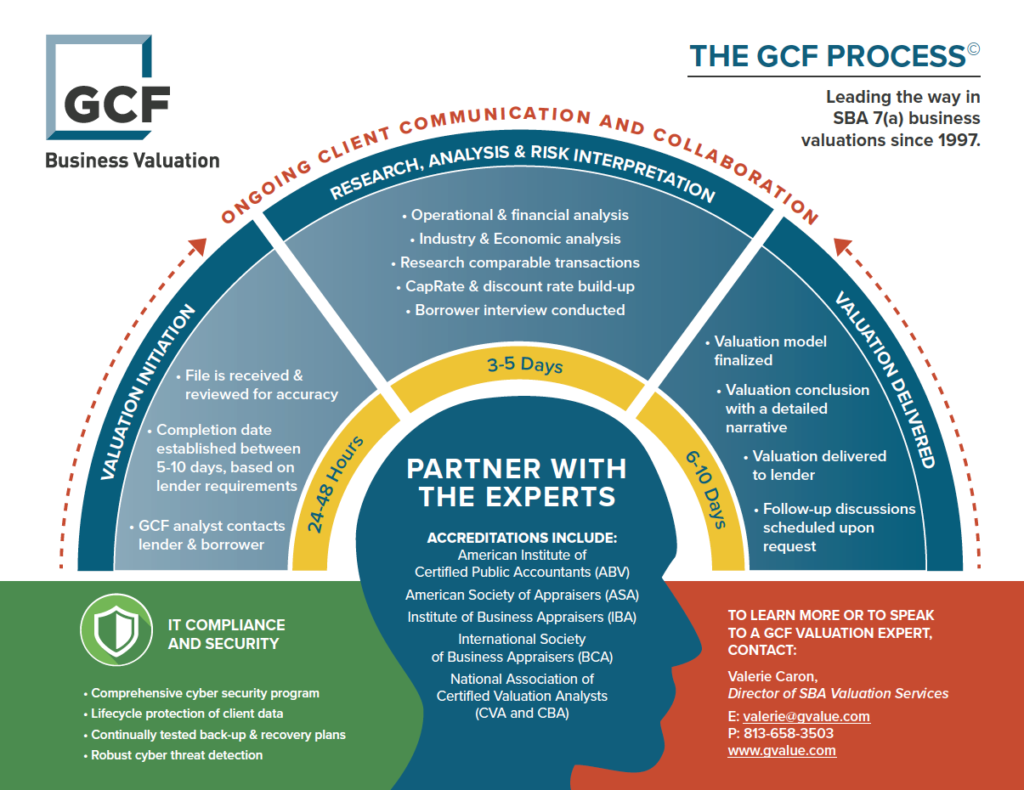

How we work for you and your borrower from START TO FINISH throughout your small business valuation:

Our main priority when our lending clients order a business valuation is to make this piece of the underwriting puzzle fit together smoothly and succinctly. We want to help ensure your success, so here are the steps we are taking behind the scenes to ensure an SBA compliant valuation is ready when you are.

- ENGAGEMENT – Engaging us is easy. A signed engagement letter, list of contacts, and a full set of financial statements is where we can start. We’ll initiate contact within 24 hours and take it from there.

- RESEARCH & DUE DILIGENCE – A critical component of an accurate valuation is data – lots of it. Our team of appraisers pulls all relevant data available, assesses and interprets risk, and then interviews sellers or borrowers to get answers to any remaining questions.

- VALUATION ANALYSIS – With all of the information compiled, our team of appraisers will develop their valuation model, calculate each valuation approach, determine which approaches will be weighted, and arrive at a final conclusion.

- COMPLETION – After our valuation conclusion has been tested for reasonableness, and our Senior Appraisers have reviewed the final conclusion, our valuation report is delivered for review, where we await for any follow-up questions.

Small Business Valuations: The GCF Difference

- We help you minimize risk: We are your second set of eyes when it comes to identifying risk. You might not catch it—but thanks to our extensive experience and seasoned team of experts, we will.

- We make it easy: We leverage the information you provide and build on that foundation. Our team will fill in the gaps to obtain all the essential data needed to complete the engagement. You don’t have to fill out a questionnaire, you don’t have to collect documents.

- We go above and beyond: We complete the process by interviewing the borrower to assure we have everything right—the first time. This is not required by you or the SBA. This is our service requirement—an added layer of due diligence that ensures a seamless process.

GCF offers the following business valuation services to SBA Lenders:

Calculation of Value: Calculation engagements (also known as “desktop appraisals”) are primarily used to meet the internal requirements of the bank for loans less than $250,000. Calculation reports are limited in scope and do not meet the SBA requirement for “3rd party business valuations.”

Business Appraisal: The GCF Business Valuation is a Restricted Use, SBA Compliant Report designed to meet SBA SOP 50 10 6 which states:

“If the amount being financed (including any 7(a), 504, seller, or other financing) minus the appraised value of real estate and/or equipment is greater than $250,000 or if there is a close relationship between the buyer and seller (for example, transactions between existing owners or family members), the Lender must obtain an independent business valuation from a qualified source”.

All GCF Reports are prepared and signed by an Accredited Appraiser and delivered within 8-10 business days from the time of engagement. For a professional business valuation that takes all factors into account, contact us.

Ready to start? Here are some documents we’ll need for an SBA business valuation:

- 3 years of business tax returns

- Interim balance sheets and income statements for the business

- Forecasted financial statements

- Purchase agreements

- Credit memo

- Commitment letter

- AR aging schedule

- Franchise agreements

- Commercial lease agreements

Keep learning about Business Valuations

– Why & When You Need a Business Valuation

– Different Types of Business Valuations

Business Valuation Accreditation

Your GCF Business Valuation appraisal team has one or more of the following business valuation accreditations:

Accredited Senior Appraiser (ASA) – is recognized as having achieved the highest level of education, training, and report writing for business valuations. The ASA designation is the gold standard for a business valuation professional. (source: American Society of Appraisers)

Accredited Senior Appraiser (ASA) – is recognized as having achieved the highest level of education, training, and report writing for business valuations. The ASA designation is the gold standard for a business valuation professional. (source: American Society of Appraisers) Certified Business Appraiser (CBA) – a very prestigious credential in the eyes of all who are familiar with it as it earned the reputation of being a difficult credential to obtain. (source: National Association of Certified Valuators and Analysts®)

Certified Business Appraiser (CBA) – a very prestigious credential in the eyes of all who are familiar with it as it earned the reputation of being a difficult credential to obtain. (source: National Association of Certified Valuators and Analysts®)

Certified Valuation Analyst (CVA)

Certified Valuation Analyst (CVA)

Accredited in Business Valuation by the American Institute of CPAs (ABV by AICPA) – a credential granted exclusively by the AICPA to qualified valuation professionals who demonstrate expertise in valuation through knowledge, skill, experience, and adherence to professional standards. (source: American Institute of CPAs)

Accredited in Business Valuation by the American Institute of CPAs (ABV by AICPA) – a credential granted exclusively by the AICPA to qualified valuation professionals who demonstrate expertise in valuation through knowledge, skill, experience, and adherence to professional standards. (source: American Institute of CPAs)- Accredited in Business Valuation (ABV) – credential is granted exclusively by the AICPA to CPAs and qualified valuation professionals who demonstrate considerable expertise in valuation through their knowledge, skill, experience, and adherence to professional standards. (source: American Institute of CPAs)

- Certified Public Accountant (CPA)

Over 25 years of experience and expertise in business valuations and appraisals. An accredited appraiser receives extensive training, remains in good standing, and follows specific industry practices to determine the value of a business.

GCF’s Machinery and Equipment Appraisal Accreditations

Expert Equipment Certified Appraiser (EECA) – Our appraisers are recognized with a deep understanding of valuation principles and extensive experience by the Institute of Equipment Valuation.

Expert Equipment Certified Appraiser (EECA) – Our appraisers are recognized with a deep understanding of valuation principles and extensive experience by the Institute of Equipment Valuation.

- Certified Machinery and Equipment Appraiser (CMEA) – a CMEA professional has the expertise and certification to conduct a third party machinery and equipment appraisal.

The GCF Business Valuation Process